I want to talk to you about something

that's tremendously important to all Californians but especially vital to our most

seasoned Californians our seniors The California Department of Insurance

is the number one consumer protection agency in our state. Our highest priority is protecting

California consumers whether they need assistance finding the right insurance

or protecting them from scam artists. Our Department is here to help.

California seniors have contributed much throughout their lives to better our

communities it is therefore alarming that insurance scam artists are praying

on their good nature. The Department of Insurance is

aggressively pursuing agents and companies that illegally target seniors

and we're working to strengthen state laws to prohibit bad behavior and make

annuity products easier to understand.

But the best way to combat this problem

is to work together. Today I want to share some information

with you in case you are approached by a pushy or deceptive insurance agent. Not all agents engage in

high-pressure sales but some do. The tips and information in this video will make

a huge difference in preventing you from being a victim of a potential

scam.

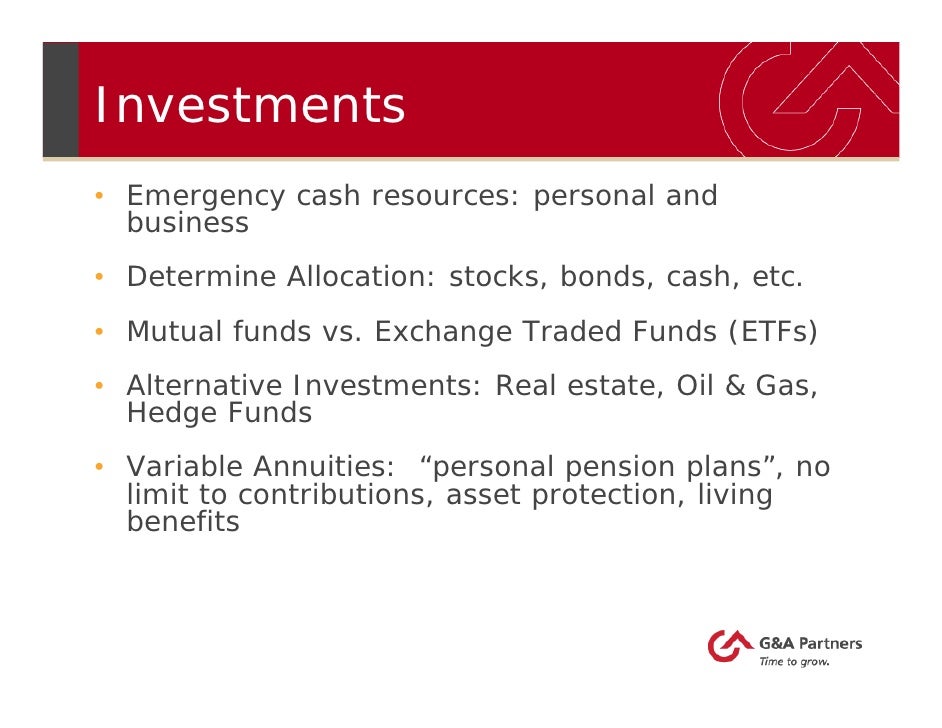

Let's take a look. Deciding when any investment is right

for you as hard enough but annuities can be very complicated

because there's so many kinds of varying terms and different payment plans. At its simplest an annuity is an

investment in the form of an insurance policy issued by an insurance company. You pay money in the form of a premium

to the insurance company in exchange for a guaranteed minimum interest rate to increase the

initial investment.

Then either right away or after a period

of years. The insurance company pays you a monthly

amount either for a set number of years or for the rest of your life. Annuity

policies might sound pretty good but there are things about these

policies that could make them a very bad choice for you, the senior investor. For example, there are often hefty

charges if you want to withdraw some of your money early.

The surrender charges can also apply at

the time of your death and will reduce the amount that your

heirs will inherit. In addition, it often turns out that the

advertised interest-rate applies only in the first year that you put money into

the annuity. Even worse is that sometimes, if the

stock market does badly, you could actually lose money. These insurance policies are very

complicated so you need to be careful that you're

not taken advantage of.

Take a look at the scenes that follow. These are examples of how you can

protect yourself from high-pressure sales tactics. You don't want to end up with an annuity that is wrong for you. At your convenience.

In the comfort of

your own home, of course. With no obligation. We'll give you a call about when we can

set up a time to chat about your particular situation and see what's best for you. So what's wrong with this picture? There's free coffee.

You've learned something that will help

you pass your assets on your children and grandchildren. The fellow seems nice enough. So what's the harm giving him your

phone number? Well let's see another way to handle it. John uh...

I learned a lot today but instead of

me giving you my phone number I would like to get your card so I can find out more information. But if you don't sign the sheet and give

us your phone number I can't call you and you might miss out on something

important. But that's okay John uh... I'll think about it.

I'll talk

to my daughter and uh... I might give you a ring, but

thanks for the food. You're welcome. I know it feels uncomfortable to reveal

to people that you don't trust them.

Even more to the point, this discomfort is what certain

high-pressure sales people and some unscrupulous insurance

companies rely on. But it's ok not to trust everyone. Sometimes we confuse having something

in common with someone as a reason to trust them. We let them in.

And sometimes that's a mistake. See if you can recognize the mistakes

Mrs. Lewinsky is about to make. [Door bell] Why John.

Why John! I wasn't expecting you. I was just

the neighborhood visiting Mrs. Smith around the corner and I thought

I'd stop by and say hello. Did you see her at the living trust seminar? No, I don't believe I know Mrs.

Smith. Oh, she says she sees you walking your dog.

Well hello there fella... What's his name? Her name is Anastasia.

Oh, Anastasia, like the lost Russian princess. Are you Russian? Are you Anastasia? No wonder

you wanted some financial advice.

No I'm not Anastasia. But I do have a fondness for Russian

cookies. Can I offer you some?

Why thank you. Well Mrs.

Lewinsky Now that you're the fourth quarter, so to

speak it would be great to make a touchdown,

wouldn't it? And just pass the ball to your son? John what are you talking about? Oh, it's just a little football metaphor

I noticed the picture of your son and I was thinking that a living trust as part of the

financial plan with good investments would make a great gift for him ultimately. Well, I was thinking about getting my

affairs in order. That's why I went to the seminar. But I don't know what I need.

I don't want to be a burden to my son, he has enough on his plate. So, you're looking for a lifetime income that will keep you independent. Well I was only interested in the

living trust. Of course, we can take care of

that too.

Now I'm going to need some information about your current investments and I'll

take care of everything. So it's all set up now. And I'd be happy to drive you over to the

bank so that you can change your name on all the accounts into the name of the trust. But before we go I'd love some more

of those cookies.

Certainly John You know Mrs. Lewinsky you could be making a lot more money

than you are now with those bank CDs and your stock accounts, too. I know all about an annuity that pays

nine percent guaranteed. I don't know how much longer the

insurance company can afford to operate like that.

I told my own mother she should

jump at it. It's an insurance policy because you

pay in the money and it protects you from the ups and downs of

the market while guaranteeing a hefty return. You know I could save you the trouble of changing all your account names too. So if you'll just sign these papers I

can get started on getting your accounts closed out and into

an annuity right away.

That seemed like a pretty normal get-together

didn't it? Well, what happened? John was picking up on all kinds of

visual cues to make a connection with Mrs. Lewinsky. It's a very common way try to gain trust. Perhaps he was just being a good

salesman.

Or perhaps he was trying to trick her. The Department of Insurance has

investigated cases in which an agent tricked people into emptying their bank

accounts and selling their stocks to pay for an annuity contract. The agent received a substantial

commission and the victims lost money. Mrs.

Lewinsky would have made

more money if she had stayed with her original

investments How could Mrs. Lewinsky protect

yourself against this kind of smooth talker? [Door bell] Oh! John I wasn't expecting you today. Oh I was just in the neighborhood visiting

with Mrs. Smith around the corner and I thought I'd stop by and say hello.

Did you see her at the seminar? I don't believe I know Mrs. Smith. What can I do for you today, John? Uh, can I come in, uh, Mrs. Lewinsky and get you started on your living trust?

Oh, did I mention that you can shelter your assets in an annuity so that you can get on MediCal? We won't be doing that today John.

I need a chance to look over the information

that I picked up from you. I'll call you when my son can be here

while we talk. What does you son do, Mrs. Lewinsky? My son looks after my money and investments

and we won't be talking without him.

Thank you for stopping by, John. So long. Two heads really are better than one. Always have someone you trust with you

when you're discussing your money or investments Even if the sales person is not a

stranger to you investments and insurance are very complicated.

According to California law, a sales person must give you written

notice that they want to meet with you at your home at least twenty four hours in advance. But if you do find yourself with the

sales person in your house don't be fooled into thinking that he's

going to look after your financial interests just because you have something in

common like an interest in football or cookies. It might be tempting for Mrs. Lewinsky

to just sign something to get rid of John.

Never sign anything on the spot with someone standing over your shoulder. Never sign forms that would give the

agent permission to transfer your money and never, ever sign blank forms. If it's a good deal today it'll also be a good deal tomorrow. The best course of action is to not let anyone into your home but if you find yourself in the living

room with John...

John, it's been very nice chatting with

you today but I'm not feeling very well okay ill disfigurement for me to go

through your files to make sure that we Okay it'll just take a minute for me to go

through your files to make sure that we haven't missed anything that should be

liquidated to fund the Pro-Am guaranteed nine percent annuity that way I can drive into the bank later and take care of everything and get it out of the way. I don't want to be impolite, but i'd like you you to leave now. Why don't you just sign these

authorizations and I'll make the transfers for you Mrs. Lewinsky that

way you can make sure that you don't miss locking up this stellar

interest rate.

John, I need more time to look over

this information. So I won't be signing anything today. But I'll call you when I've looked it over..

Why don't I just show you to the door. But there's a thirty day free look

period anyway that means you can cancel at any time and get all your money back so you might as well sign then I don't

have to bother you again you can just cancel if you decide

against the annuity you can just put all your money back and put it into the

mutual funds with no consequences Isn't there a tax problem to selling

mutual funds? Well, I won't be signing anything today.

Goodbye, John. Mrs. Lewinsky, you don't have to be

so rude! Annuities are very complicated investments that may not be right for you because they can't lock your money up

for a long time. You need to make sure you keep enough money

outside of the annuity to take care of unforeseen expenses You also need to know what interest rate

the annuity will pay past the first year You'll also need to look at how much risk you

want to take on and decide between an annuity with a fixed interest rate or one that will vary.

Look closely at the terms of the annuity read the documents ask questions to make sure you

understand them and take notes. Don't be a victim! Always know and understand anything you

sign If an offer seems too good to be true it

probably is too good to be true the salesperson insists that you sign

right away That's a danger sign. If it's a reputable deal it will still

be available next week. If you don't understand something ask questions there are no stupid

questions.

Never allow someone to try to sell you

insurance or an investment without giving you the time to think

about it and without a trusted friend or relative

by your side. You always have the power to say no! After all it's your money. There's no shame in becoming confused

about financial planning and if you do it's okay to end the talk

at any time. Honest sales people understand and will not pressure you further.

Honest salespeople will not insist that they talk to you alone. The law is on your side. And we are on your side. To help you at any time call the California Department of

Insurance Hotline at 1-800-927-HELP.

Today there are more insurance options

for seniors than ever before. With so many choices picking the right one can

seem like a daunting task the California Department of Insurance

is here to help you make those important decisions we want to make sure you feel

equipped to make informed assessments of your insurance needs and

options. If you have any questions about an

insurance product, agent or broker, don't hesitate to call the Department of

Insurance at 1-800-927-HELP. Thanks for joining us today and we look

forward to hearing from you.

[Music].